Cara Registrasi Kartu Telkomsel Baru

Cara Registrasi Kartu Telkomsel Baru 2017

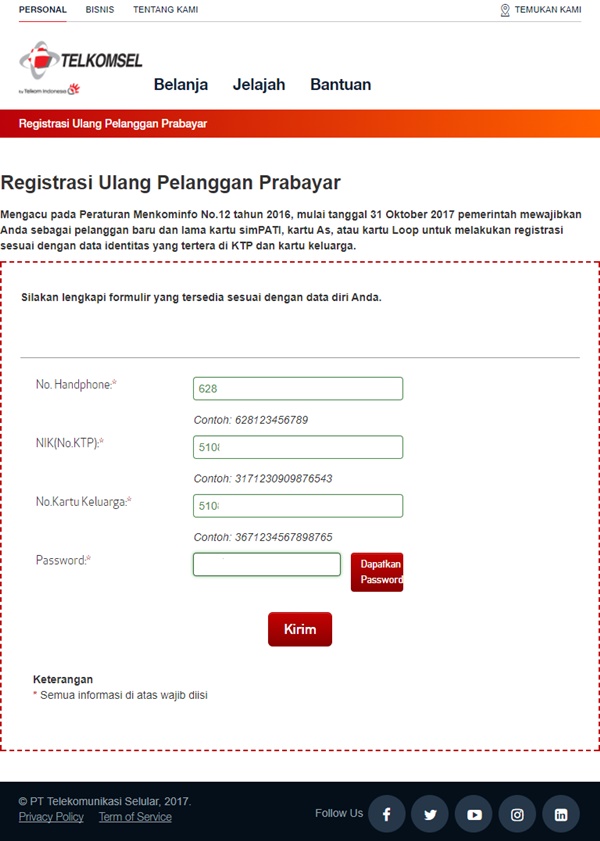

Panduan lengkap langkah-langkah cara registrasi kartu perdana simpati, Telkomsel, As, Xl dan Axis, Daftar dan Mengaktifkan kartu sim baru. Panduan lengkap langkah-langkah cara registrasi kartu perdana simpati, Telkomsel, As, Xl dan Axis, Daftar dan Mengaktifkan kartu sim baru. Melainkan tugas saya hanya sekedar ingin memberikan sedikit. Experience the faster 4G network. Registrasi Prabayar Register Your Prepaid Number For More Secure According to the regulation of Ministry of Communication & Informatics number 10/2010, Indonesian Government will obligate all Prepaid customer to register their number, using a validated National Identity Number/ NIK.

Insurance Perks Insurance not just works well for making smart and convenient financial strategies, additionally works well for securing the absolute best future for the family members. Insurance seals the deal for a far better future and also a safe one and has lots of helpful factors also. An insurance Isn‘t about one’s own safe measure or a simple receding life, it will plenty to guard and help the longer term generation of a specific family in desperate times demanding desperate measures. Here will be the few perks that come attached using the deal of Insurance Benefits.

Cara Registrasi Kartu Telkomsel Baru 2018

Final expenses taken care of Insurance benefits you to chalk out the last expenses of that sort of funeral expenses or medical bills that Haven‘t been covered inside the health insurance, by satisfying means. The final of acceptable expenses such as the mortgage balance may also be covered from our advantage to your relief. Whether it is the cremation expenditures or other kind of flooding of cash that‘s required on the legal ground, these insurance benefits manage what could be handled.

Inheritance like a blessing It‘s also been stated that owning a policy having a wishful Heir’s name like a beneficiary just to safeguard an inheritance for the dear ones is among the many perks that an insurance provides like a benefit. The death benefit also can appear like a helpful supplement to other kind of inheritance funds that you could make a decision with your rightful sense to leave within your heirs like a sign of your respective aspect in securing their future and giving them something to start with in case a predicament therefore ever arises inside the forefront. Benevolent moves Having a heart made of unselfishness and kindness, Life insurance policies also offer you the ideal to produce a policy with your selected charity like a titled beneficiary. This will ensure that all of your charitable goals are seen to after you breathe your last and the advantages are provided towards the charity of your respective pick even when you do not have a gigantic estate to become left behind like a contribution. Glancing through these points of occurrence, does not it now relax you to understand There‘s something you are able to fall back on? Something that will assist you in monetary matters if you get little else to depend upon?

Maybe that would simply help you earn a very good and kind deed even whenever you part ways vivaciously? Then ensure to obtain a policy done for you to ultimately enjoy these perks and live peacefully for the remaining days. How Important Are Insurance Carrier Ratings and Insurance Tracking Solution Software? What is definitely an insurance policy? It‘s a promise or an assurance to pay out just in case of the covered damage or loss. The insurance carrier promises to cover the loss and pay during a financial disaster.

Although, the commercial insurance has turned out to become quite complex and expensive, yet a very good coverage could be your only security against the monetary catastrophe during a significant claim. Perhaps you have every considered how would your condition be when the insurance company fails to keep your promise during time of your respective need? This really is in which the insurance tracking solution software comes forward. It isn‘t a simple task to predict which insurance carrier is the greatest and safe, from numerous possibilities. But, the ratings provided by various agencies could be of valuable assistance to select the foremost trusted one inside the crowd.

The carrier goes through rigorous evaluation procedures comprising reviewing business plans, reinsurance, financial statements, rates of interest, regulations, credit, funding criteria, and actual reporting for being rated. Such severe analysis works well for measuring the actual capabilities of solvency from the carriers. The ratings receive using noble benchmarks between grades A to F. The insurance firms possessing grades A or A+ are considered as being superior ones within the complete industry. The excellent ones are rated A or A- and also the good ones are rated B or B+. The insurance companies’ ratings between A and B are considered financially secure companies and also the carrier rating C are said to get on the marginal line.

Each Insurance Carrier has North American Industry Classification System (NAICS ) codes to know the specific rating. It helps to classify each carrier inside the industry to gather, analyze, and publish the statistical data. Insurance Carrier Thresholds & Why it matters You should be wondering what an insurance carrier threshold is. It‘s nothing but a tested method to decrease the risk. Often it becomes difficult for any company to undergo the financial records and ratings regularly. In such cases, even when the ratings of the trusted and functional insurance concern go down.